Boston House Price Prediction

Regression is basically a process which predicts the relationship between x and y based on features. This time we are going to practice Linear Regression with Boston House Price Data that are already embedded in scikit-learn datasets.

Useful functions

-

sklearn.metrics.mean_squared_error: famous evaluation method (MSE)

-

np.sqrt(x): square root of tensor x

-

linear_model.coef_ : get

Regression coefficientof the fitted linear model

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

import sklearn.datasets as datasets

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LinearRegression

from sklearn.metrics import mean_squared_error

BOSTON_DATA = datasets.load_boston()

Simple EDA

# Load both boston data and target, and convert it as dataframe.

def add_target_to_data(dataset):

# make the raw dataset cleaner and easier to process -> use dataframe

df = pd.DataFrame(dataset.data, columns=dataset.feature_names)

# put the target data (price) to the dataframe we just made.

print("Before adding target: ", df.shape)

df['PRICE'] = dataset.target

print("After adding target: {} \n {}\n".format(df.shape, df.head(2)))

return df

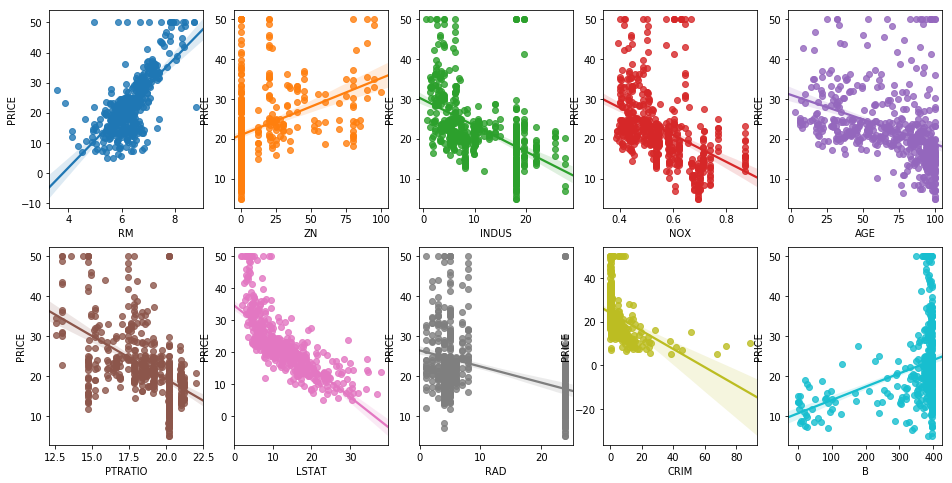

"""

10 features as default.

Why didn't I put all the 13 features? Because n_row=2 and n_col=5 as default.

It will create 10 graphs for each features.

"""

def plotting_graph(df, features, n_row=2, n_col=5):

fig, axes = plt.subplots(n_row, n_col, figsize=(16, 8))

assert len(features) == n_row * n_col

# Draw a regression graph using seaborn's regplot

for i, feature in enumerate(features):

row = int(i / n_col)

col = i % n_col

sns.regplot(x=feature, y='PRICE', data=df, ax=axes[row][col])

plt.show()

def split_dataframe(df):

label_data = df['PRICE']

# others without PRICE

# axis!! --> Whether to drop labels from the index (0 or ‘index’) or columns (1 or ‘columns’).

input_data = df.drop(['PRICE'], axis=1)

# split! Set random_state if you want consistently same result

input_train, input_eval, label_train, label_eval = train_test_split(input_data, label_data, test_size=0.3,

random_state=42)

return input_train, input_eval, label_train, label_eval

boston_df = add_target_to_data(BOSTON_DATA)

features = ['RM', 'ZN', 'INDUS', 'NOX', 'AGE', 'PTRATIO', 'LSTAT', 'RAD', 'CRIM', 'B']

plotting_graph(boston_df, features, n_row=2, n_col=5)

Before adding target: (506, 13)

After adding target: (506, 14)

CRIM ZN INDUS CHAS NOX RM AGE DIS RAD TAX \

0 0.00632 18.0 2.31 0.0 0.538 6.575 65.2 4.0900 1.0 296.0

1 0.02731 0.0 7.07 0.0 0.469 6.421 78.9 4.9671 2.0 242.0

PTRATIO B LSTAT PRICE

0 15.3 396.9 4.98 24.0

1 17.8 396.9 9.14 21.6

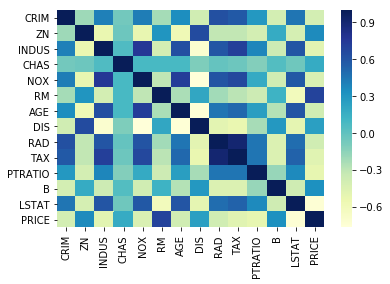

'''

The correlation coefficient ranges from -1 to 1.

If the value is close to 1, it means that there is a strong positive correlation between the two variables.

When it is close to -1, the variables have a strong negative correlation.

'''

correlation_matrix = boston_df.corr().round(2)

Output:

| CRIM | ZN | INDUS | CHAS | NOX | RM | AGE | DIS | RAD | TAX | PTRATIO | B | LSTAT | PRICE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CRIM | 1.00 | -0.20 | 0.41 | -0.06 | 0.42 | -0.22 | 0.35 | -0.38 | 0.63 | 0.58 | 0.29 | -0.39 | 0.46 | -0.39 |

| ZN | -0.20 | 1.00 | -0.53 | -0.04 | -0.52 | 0.31 | -0.57 | 0.66 | -0.31 | -0.31 | -0.39 | 0.18 | -0.41 | 0.36 |

| INDUS | 0.41 | -0.53 | 1.00 | 0.06 | 0.76 | -0.39 | 0.64 | -0.71 | 0.60 | 0.72 | 0.38 | -0.36 | 0.60 | -0.48 |

| CHAS | -0.06 | -0.04 | 0.06 | 1.00 | 0.09 | 0.09 | 0.09 | -0.10 | -0.01 | -0.04 | -0.12 | 0.05 | -0.05 | 0.18 |

| NOX | 0.42 | -0.52 | 0.76 | 0.09 | 1.00 | -0.30 | 0.73 | -0.77 | 0.61 | 0.67 | 0.19 | -0.38 | 0.59 | -0.43 |

| RM | -0.22 | 0.31 | -0.39 | 0.09 | -0.30 | 1.00 | -0.24 | 0.21 | -0.21 | -0.29 | -0.36 | 0.13 | -0.61 | 0.70 |

| AGE | 0.35 | -0.57 | 0.64 | 0.09 | 0.73 | -0.24 | 1.00 | -0.75 | 0.46 | 0.51 | 0.26 | -0.27 | 0.60 | -0.38 |

| DIS | -0.38 | 0.66 | -0.71 | -0.10 | -0.77 | 0.21 | -0.75 | 1.00 | -0.49 | -0.53 | -0.23 | 0.29 | -0.50 | 0.25 |

| RAD | 0.63 | -0.31 | 0.60 | -0.01 | 0.61 | -0.21 | 0.46 | -0.49 | 1.00 | 0.91 | 0.46 | -0.44 | 0.49 | -0.38 |

| TAX | 0.58 | -0.31 | 0.72 | -0.04 | 0.67 | -0.29 | 0.51 | -0.53 | 0.91 | 1.00 | 0.46 | -0.44 | 0.54 | -0.47 |

| PTRATIO | 0.29 | -0.39 | 0.38 | -0.12 | 0.19 | -0.36 | 0.26 | -0.23 | 0.46 | 0.46 | 1.00 | -0.18 | 0.37 | -0.51 |

| B | -0.39 | 0.18 | -0.36 | 0.05 | -0.38 | 0.13 | -0.27 | 0.29 | -0.44 | -0.44 | -0.18 | 1.00 | -0.37 | 0.33 |

| LSTAT | 0.46 | -0.41 | 0.60 | -0.05 | 0.59 | -0.61 | 0.60 | -0.50 | 0.49 | 0.54 | 0.37 | -0.37 | 1.00 | -0.74 |

| PRICE | -0.39 | 0.36 | -0.48 | 0.18 | -0.43 | 0.70 | -0.38 | 0.25 | -0.38 | -0.47 | -0.51 | 0.33 | -0.74 | 1.00 |

sns.heatmap(correlation_matrix, cmap="YlGnBu")

plt.show()

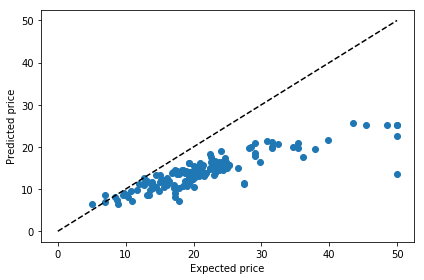

Prediction with Linear Regression

X_train, X_test, Y_train, Y_test = split_dataframe(boston_df)

# Load your machine learning model

model = LinearRegression()

# Train!

model.fit(X_train, Y_train)

# make prediction with unseen data!

pred = model.predict(X_test)

expectation = Y_test

# what is mse between the answer and your prediction?

lr_mse = mean_squared_error(expectation, pred)

lr_rmse = np.sqrt(lr_mse)

print('LR_MSE: {0:.3f}, LR_RMSE: {1:.3F}'.format(lr_mse, lr_rmse))

# Regression Coefficient

print('Regression Coefficients:', np.round(model.coef_, 1))

# sort from the biggest

coeff = pd.Series(data=model.coef_, index=X_train.columns).sort_values(ascending=False)

print(coeff)

Output:

LR_MSE: 21.517, LR_RMSE: 4.639

Regression Coefficients: [ -0.1 0. 0. 3.1 -15.4 4.1 -0. -1.4 0.2 -0. -0.9 0.

-0.5]

RM 4.057199

CHAS 3.119835

RAD 0.242727

INDUS 0.049523

ZN 0.035809

B 0.011794

TAX -0.008702

AGE -0.010821

CRIM -0.133470

LSTAT -0.547113

PTRATIO -0.910685

DIS -1.385998

NOX -15.417061

dtype: float64

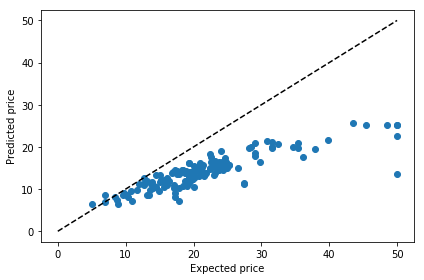

plt.scatter(expectation, pred)

plt.plot([0, 50], [0, 50], '--k')

plt.xlabel('Expected price')

plt.ylabel('Predicted price')

plt.tight_layout()

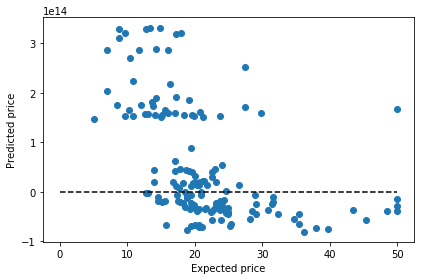

Prediction with other Regression methods

- Ridge, Lasso and ElasticNet

- Gradient Boosting Regressor

- XG Boost

- SGD Regressor According to sklearn’s official documentation,

“SGDRegressor is well suited for regression problems with a large number of training samples (> 10,000), for other problems we recommend Ridge, Lasso, or ElasticNet.”

from sklearn.linear_model import Ridge, Lasso, ElasticNet, SGDRegressor

from sklearn.ensemble import GradientBoostingRegressor

from xgboost import XGBRegressor

# Try tuning the hyper-parameters

models = {

"Ridge" : Ridge(),

"Lasso" : Lasso(),

"ElasticNet" : ElasticNet(),

"Gradient Boosting" : GradientBoostingRegressor(),

"SGD" : SGDRegressor(max_iter=1000, tol=1e-3),

"XGB" : XGBRegressor(objective ='reg:linear', colsample_bytree = 0.3, learning_rate = 0.1,

max_depth = 5, alpha = 10, n_estimators = 10)

}

pred_record = {}

for name, model in models.items():

# Load your machine learning model

curr_model = model

# Train!

curr_model.fit(X_train, Y_train)

# make prediction with unseen data!

pred = curr_model.predict(X_test)

expectation = Y_test

# what is mse between the answer and your prediction?

mse = mean_squared_error(expectation, pred)

rmse = np.sqrt(mse)

print('{} MSE: {}, {} RMSE: {}'.format(name, mse, name, rmse))

pred_record.update({name : pred})

Output:

Ridge MSE: 22.044053089861013, Ridge RMSE: 4.695109486461526

Lasso MSE: 25.639502928043992, Lasso RMSE: 5.063546477326341

ElasticNet MSE: 25.40519636428209, ElasticNet RMSE: 5.040356769543411

Gradient Boosting MSE: 7.737869423986623, Gradient Boosting RMSE: 2.781702612427616

SGD MSE: 1.5570858695910825e+28, SGD RMSE: 124783246855941.47

[20:06:46] WARNING: src/objective/regression_obj.cu:152: reg:linear is now deprecated in favor of reg:squarederror.

XGB MSE: 82.71679422016705, XGB RMSE: 9.094877361469315

prediction = pred_record["SGD"]

plt.scatter(expectation, prediction)

plt.plot([0, 50], [0, 50], '--k')

plt.xlabel('Expected price')

plt.ylabel('Predicted price')

plt.tight_layout()

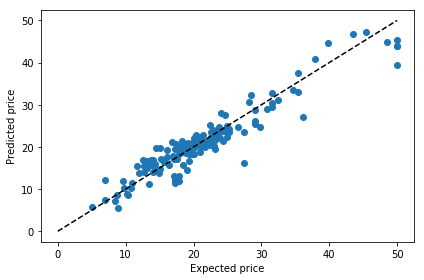

prediction = pred_record["XGB"]

plt.scatter(expectation, prediction)

plt.plot([0, 50], [0, 50], '--k')

plt.xlabel('Expected price')

plt.ylabel('Predicted price')

plt.tight_layout()

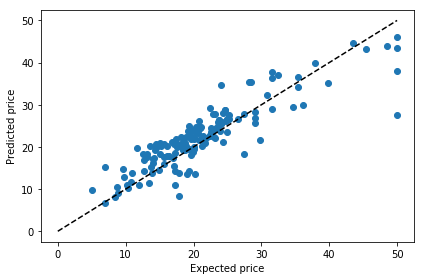

prediction = pred_record["Gradient Boosting"]

plt.scatter(expectation, prediction)

plt.plot([0, 50], [0, 50], '--k')

plt.xlabel('Expected price')

plt.ylabel('Predicted price')

plt.tight_layout()

A Little Taster Session for Neural Network

from tensorflow import keras

from tensorflow.keras.layers import add, Dense, Activation

def neural_net():

model = keras.Sequential()

model.add(Dense(512, input_dim=BOSTON_DATA.data.shape[1]))

model.add(Activation('relu'))

model.add(Dense(256))

model.add(Activation('relu'))

model.add(Dense(128))

model.add(Activation('relu'))

model.add(Dense(64))

model.add(Activation('relu'))

model.add(Dense(1))

return model

model = neural_net()

model.summary()

Output:

Model: "sequential_10"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

dense_31 (Dense) (None, 512) 7168

_________________________________________________________________

activation_24 (Activation) (None, 512) 0

_________________________________________________________________

dense_32 (Dense) (None, 256) 131328

_________________________________________________________________

activation_25 (Activation) (None, 256) 0

_________________________________________________________________

dense_33 (Dense) (None, 128) 32896

_________________________________________________________________

activation_26 (Activation) (None, 128) 0

_________________________________________________________________

dense_34 (Dense) (None, 64) 8256

_________________________________________________________________

activation_27 (Activation) (None, 64) 0

_________________________________________________________________

dense_35 (Dense) (None, 1) 65

=================================================================

Total params: 179,713

Trainable params: 179,713

Non-trainable params: 0

_________________________________________________________________

model.compile(loss='mse', optimizer='adam', metrics=['accuracy'])

history = model.fit(X_train, Y_train, epochs=100)

loss, test_acc = model.evaluate(X_test, Y_test)

print('Test Loss : {:.4f} | Test Accuracy : {}'.format(loss, test_acc))

prediction = model.predict(X_test)

plt.scatter(expectation, prediction)

plt.plot([0, 50], [0, 50], '--k')

plt.xlabel('Expected price')

plt.ylabel('Predicted price')

plt.tight_layout()

Leave a comment